social security tax rate 2021

Exceed 142800 the amount in excess of 142800 is not subject to the Social Security tax. Social Security and Medicare Withholding Rates The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total.

Tax Structure Tax Base Tax Rate Proportional Regressive And Progressive Taxation

You cant pay more than 18228 in taxes for Social Security in 2021.

. Be aware that this doesnt apply to the 145 Medicare tax. Any income you earn beyond the wage cap amount is not subject to a 62 Social Security payroll tax. The social security tax is calculated for every tax year and the tax rate for the year 2021 was 124 to be funded by employers and employees in equal proportion.

Nobody Pays Taxes on More Than 85 of Their Social Security Benefits. Social Security taxes in 2022 are 62 percent of gross wages up to 147000. If an employees 2021 wages salaries etc.

D Tax-exempt interest plus any exclusions from income. 62 of each employees first 142800 of wages salaries etc. If your combined income was more than 34000 you will pay taxes on up to 85 of your Social Security benefits.

The maximum wage base has been increased to 147000 for the year 2022. That is a 5100 increase from the 2020 wage-based cap. Workers pay a 62 Social Security tax on their earnings until they reach 142800 in earnings for the year.

Those who are self-employed are liable for the full 124. 1470 5880 for four. As of 2021 that amount increased to 65 percent and in 2022 the benefits will be completely exempt for those taxpayers.

By continuing to use this site you consent to the use of cookies on your device as described in our cookie policy unless you have disabled them. In 2021 you will pay Social Security taxes on all of your income up to 142800. 2021 taxes were rejected - Answered by a verified Social Security Expert We use cookies to give you the best possible experience on our website.

Worksheet to Determine if Bene ts May Be Taxable A Amount of Social Security or Railroad. Note that not everyone pays taxes on benefits but clients who have other income in retirement beyond Social Security will likely pay taxes on their benefit. Max OASDI Max HI Employee 765 62 - OASDI 145 - HI 885360 No limit Employer 765 62 - OASDI 145 - HI 885360 No limit Self-employed 1530 124 - OASDI 29 - HI 1770720 No limit Earnings Required for a Quarter of Coverage in 2021.

Social Security Tax Rates. If you have clients who earn more than a certain amount from other sources while also collecting Social Security part of their benefit payment must be added to their taxable income on. Everyone pays the same rate regardless of how much they earn until they hit the ceiling.

The Social Security taxable maximum is 142800 in 2021. If you earn 142800 per year in 2021 the maximum youll pay in Social Security taxes is 62 of your income or 885360 per year. Your employer would contribute an.

Worksheet to Determine if Benefits May Be Taxable. The current rate for Medicare is 145 for the employer and 145 for the employee or 29 total. Social Security Payroll Tax for 2021.

B One-half of amount on line A. Ad When Do You Have to Pay Income Taxes on Your Social Security Benefits. Read More at AARP.

I need to fix 2021 taxes and 2020 taxes. For the 2021 tax year which you will file in 2022 single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security benefits. Social Security benefits include monthly retirement survivor and disability benefits.

How Much You Will Get From Social Security. Quarter of 2019 through the third quarter of 2020 Social Security and Supplemental Security Income SSI beneficiaries will receive a 13 percent COLA for 2021. The employers Social Security payroll tax rate for 2021 January 1 through December 31 2021 is the same as the employees Social Security payroll tax.

Social Security functions much like a flat tax. That is a 5100 increase from the 2020 wage-based cap. IRS Tax Tip 2021-66 May 12 2021 Taxpayers receiving Social Security benefits may have to pay federal income tax on a portion of those benefits.

An employees 2021 earnings in excess of 142800 are not subject to the Social Security tax. For both 2021 and 2022 the Social Security tax rate for employees and employers is 62 of employee compensation for a total of 124. They dont include supplemental security income payments which arent taxable.

As of 2021 a single rate of 124 is applied to all wages and self-employment income earned by a worker up to a maximum dollar limit of 142800. For example an employee who earns 165000 in 2022 will pay 9114 in Social Security taxes. Their income used to determine if Social Security bene ts are taxable 37500 is greater than the taxable Social Security base amount 32000 for joint lers.

The employees Social Security payroll tax rate for 2021 January 1 through December 31 2021 is 62 of the first 142800 of wages salaries etc. Beginning in tax year 2020 the state exempted 35 percent of benefits for qualifying taxpayers. Thus the most an individual employee can pay this year is 9114 Most workers pay their share through FICA Federal Insurance Contributions Act taxes withheld from their paychecks.

Therefore some of their Social Security bene ts are taxable. The Social Security Wage Base means that youll only ever pay Social Security taxes on 147700 and nothing else. The maximum wage base for the tax rate is 142800 for 2021.

C Taxable pensions wages interest dividends and other. What is the Social Security tax rate. A Amount of Social Security or Railroad Retirement Benefits.

Social security benefits tax calculator is in a way concrete answer to often asked question Are social security benefits taxableWell social security benefits are taxable to some people and totally tax-free for others as the taxation depends on the computation of total income and other phaseout values which are again dependent on your tax filing status.

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable After Age 62

/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated

Social Security Wage Base Increases To 142 800 For 2021

/heroexportjourney-4229705-df42b41ba8f7483fba08a542a4eae4ac.jpg)

Social Security Tax Definition

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

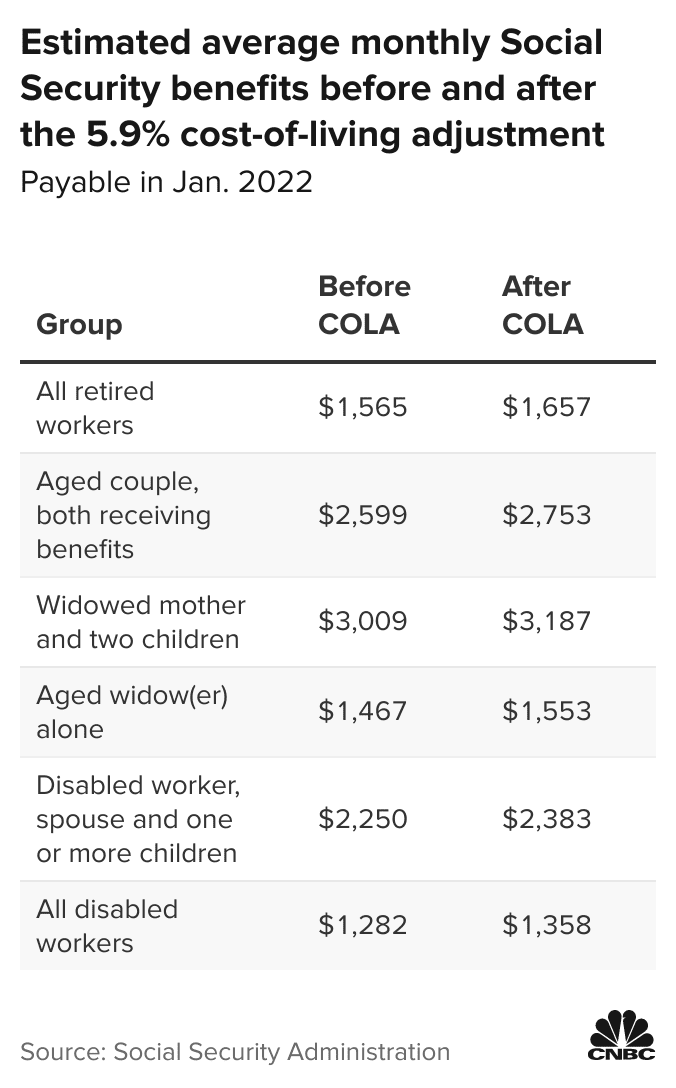

Social Security Cost Of Living Adjustment Will Be 5 9 In 2022 Biggest Annual Hike In 40 Years

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Social Security Taxes 2022 Are Payroll Taxes Changing In 2022 Marca

Social Security And Taxes Could There Be A Tax Torpedo In Your Future Apprise Wealth Management

2021 2022 Tax Brackets And Federal Income Tax Rates

Social Security Cost Of Living Adjustment Will Be 5 9 In 2022 Biggest Annual Hike In 40 Years

Who Pays U S Income Tax And How Much Pew Research Center

How Do Taxes Affect The Economy In The Short Run Tax Policy Center

Understanding Your Tax Forms The W 2

How Much Does A Small Business Pay In Taxes

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)